5 Travel Tips to Help You Stay Financially Safe

Posted by

Sydney on Jun 7, 2018 2:04:00 PM

Unlock Your Banking Potential

Posted by

Katherine on Jan 17, 2018 3:02:41 PM

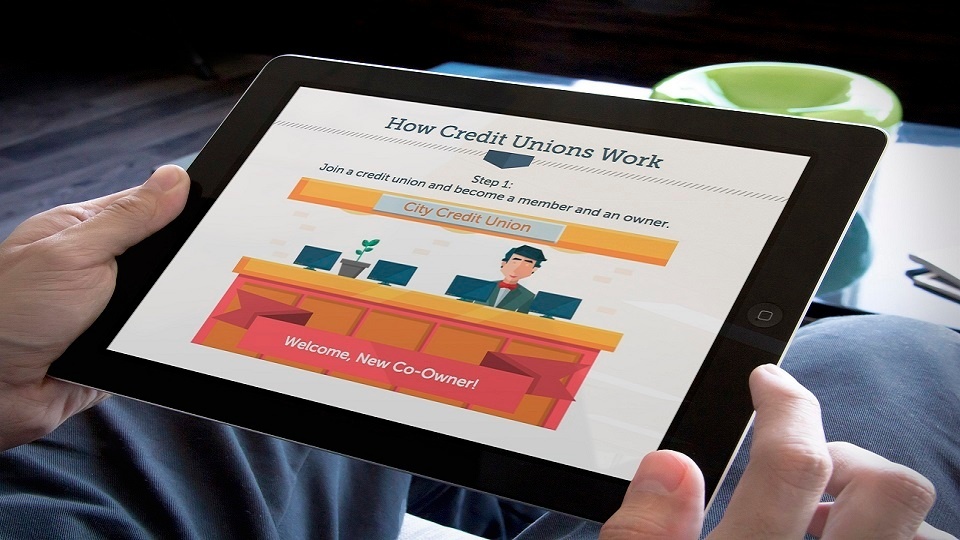

USC Credit Union has now partnered with EverFi, a leader in financial education, to bring you Financial Focu$, a set of courses to set you on the right track. Whether you are a freshman just starting to get your feet wet in a new ocean of responsibility, or a college graduate already in the workforce, Financial Focu$ will help you take control of your financial future.